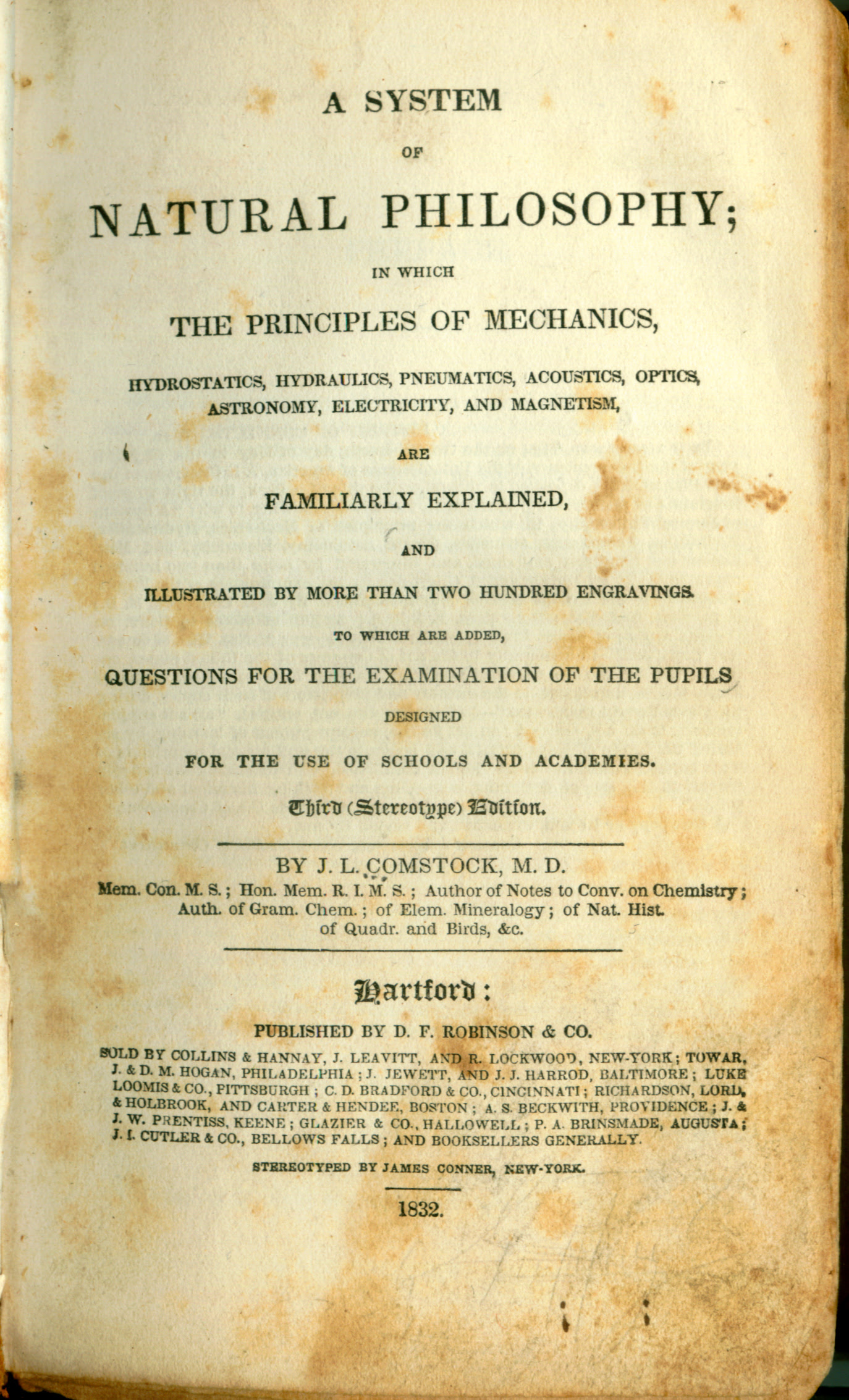

Managing Credit Risk: The Next Great Financial Challenge (Frontiers in Finance Series) by John B. Caouette, Edward I. Altman

The first full analysis of the latest advances in managing credit risk. Against a backdrop of radical industry evolution, the authors of Managing Credit Risk: The Next Great Financial Challenge provide a concise and practical overview of these dramatic market and technical developments in a book which is destined to become a standard reference in the field. -Thomas C. Wilson, Partner, McKinsey & Company, Inc. Managing Credit Risk is an outstanding intellectual achievement. The authors have provided investors a comprehensive view of the state of credit analysis at the end of the millennium. -Martin S. Fridson, Financial Analysts Journal. This book provides a comprehensive review of credit risk management that should be compulsory reading for not only those who are responsible for such risk but also for financial analysts and investors. An important addition to a significant but neglected subject. -B.J. Ranson, Senior Vice-President, Portfolio Management, Bank of Montreal. The phenomenal growth of the credit markets has spawned a powerful array of new instruments for managing credit risk, but until now there has been no single source of information and commentary on them. In Managing Credit Risk, three highly regarded professionals in the field have-for the first time-gathered state-of-the-art information on the tools, techniques, and vehicles available today for managing credit risk. Throughout the book they emphasize the actual practice of managing credit risk, and draw on the experience of leading experts who have successfully implemented credit risk solutions. Starting with a lucid analysis of recent sweeping changes in the U.S. and global financial markets, this comprehensive resource documents the credit explosion and its remarkable opportunities-as well as its potentially devastating dangers. Analyzing the problems that have occurred during its growth period-S&L failures, business failures, bond and loan defaults, derivatives debacles-and the solutions that have enabled the credit market to continue expanding, Managing Credit Risk examines the major players and institutional settings for credit risk, including banks, insurance companies, pension funds, exchanges, clearinghouses, and rating agencies. By carefully delineating the different perspectives of each of these groups with respect to credit risk, this unique resource offers a comprehensive guide to the rapidly changing marketplace for credit products. Managing Credit Risk describes all the major credit risk management tools with regard to their strengths and weaknesses, their fitness to specific financial situations, and their effectiveness. The instruments covered in each of these detailed sections include: credit risk models based on accounting data and market values; models based on stock price; consumer finance models; models for small business; models for real estate, emerging market corporations, and financial institutions; country risk models; and more. There is an important analysis of default results on corporate bonds and loans, and credit rating migration. In all cases, the authors emphasize that success will go to those firms that employ the right tools and create the right kind of risk culture within their organizations. A strong concluding chapter integrates emerging trends in the financial markets with the new methods in the context of the overall credit environment. Concise, authoritative, and lucidly written, Managing Credit Risk is essential reading for bankers, regulators, and financial market professionals who face the great new challenges-and promising rewards-of credit risk management. Editorial Reviews Review ...I recommend this book to anybody involved in the management of credit...a very worthwhile addition... (Credit Focus, August 2005) From the Publisher This essential resource draws upon financial insights derived from the S&L crisis of the 80s, as well as newly emerging financial practices in today's derivatives markets, to illustrate today's most innovative and homogenized approaches to controlling credit risk. The author exhaustively reviews every important, emerging technique of credit risk management and evaluates its impact on today's global financial markets. From the Back Cover The first full analysis of the latest advances in managing credit risk. Against a backdrop of radical industry evolution, the authors of Managing Credit Risk: The Next Great Financial Challenge provide a concise and practical overview of these dramatic market and technical developments in a book which is destined to become a standard reference in the field. -Thomas C. Wilson, Partner, McKinsey & Company, Inc. Managing Credit Risk is an outstanding intellectual achievement. The authors have provided investors a comprehensive view of the state of credit analysis at the end of the millennium. -Martin S. Fridson, Financial Analysts Journal. This book provides a comprehensive review of credit risk management that should be compulsory reading for not only those who are responsible for such risk but also for financial analysts and investors. An important addition to a significant but neglected subject. -B.J. Ranson, Senior Vice-President, Portfolio Management, Bank of Montreal. The phenomenal growth of the credit markets has spawned a powerful array of new instruments for managing credit risk, but until now there has been no single source of information and commentary on them. In Managing Credit Risk, three highly regarded professionals in the field have-for the first time-gathered state-of-the-art information on the tools, techniques, and vehicles available today for managing credit risk. Throughout the book they emphasize the actual practice of managing credit risk, and draw on the experience of leading experts who have successfully implemented credit risk solutions. Starting with a lucid analysis of recent sweeping changes in the U.S. and global financial markets, this comprehensive resource documents the credit explosion and its remarkable opportunities-as well as its potentially devastating dangers. Analyzing the problems that have occurred during its growth period-S&L failures, business failures, bond and loan defaults, derivatives debacles-and the solutions that have enabled the credit market to continue expanding, Managing Credit Risk examines the major players and institutional settings for credit risk, including banks, insurance companies, pension funds, exchanges, clearinghouses, and rating agencies. By carefully delineating the different perspectives of each of these groups with respect to credit risk, this unique resource offers a comprehensive guide to the rapidly changing marketplace for credit products. Managing Credit Risk describes all the major credit risk management tools with regard to their strengths and weaknesses, their fitness to specific financial situations, and their effectiveness. The instruments covered in each of these detailed sections include: credit risk models based on accounting data and market values; models based on stock price; consumer finance models; models for small business; models for real estate, emerging market corporations, and financial institutions; country risk models; and more. There is an important analysis of default results on corporate bonds and loans, and credit rating migration. In all cases, the authors emphasize that success will go to those firms that employ the right tools and create the right kind of risk culture within their organizations. A strong concluding chapter integrates emerging trends in the financial markets with the new methods in the context of the overall credit environment. Concise, authoritative, and lucidly written, Managing Credit Risk is essential reading for bankers, regulators, and financial market professionals who face the great new challenges-and promising rewards-of credit risk management. About the Author JOHN B. CAOUETTE is President of the Structured Finance Division of MBIA Insurance Corporation. He was formerly Chairman and CEO of Capital Markets Assurance Corporation. EDWARD I. ALTMAN is the Max Heine Professor of Finance at New York University Stern School of Business and Vice Director of its Salomon Center. His previous publications include Corporate Bankruptcy in America and Corporate Finance and Bankruptcy (Wiley). PAUL NARAYANAN is a credit and financial risk consultant who has worked in risk management at Chase Manhattan Bank, BankBoston, and Meritor PSFS. He is cobuilder of the Zeta model and has designed and implemented risk models for consumer, residential, and corporate sectors.

Publication Details

Title:

Author(s):

Illustrator:

Binding: Hardcover

Published by: Wiley: , 1998

Edition:

ISBN: 9780471111894 | 0471111899

464 pages.

Book Condition: Very Good

Pickup available at Book Express Warehouse

Usually ready in 4 hours

Product information

New Zealand Delivery

Shipping Options

Shipping options are shown at checkout and will vary depending on the delivery address and weight of the books.

We endeavour to ship the following day after your order is made and to have pick up orders available the same day. We ship Monday-Friday. Any orders made on a Friday afternoon will be sent the following Monday. We are unable to deliver on Saturday and Sunday.

Pick Up is Available in NZ:

Warehouse Pick Up Hours

- Monday - Friday: 9am-5pm

- 62 Kaiwharawhara Road, Wellington, NZ

Please make sure we have confirmed your order is ready for pickup and bring your confirmation email with you.

Rates

-

New Zealand Standard Shipping - $6.00

- New Zealand Standard Rural Shipping - $10.00

- Free Nationwide Standard Shipping on all Orders $75+

Please allow up to 5 working days for your order to arrive within New Zealand before contacting us about a late delivery. We use NZ Post and the tracking details will be emailed to you as soon as they become available. Due to Covid-19 there have been some courier delays that are out of our control.

International Delivery

We currently ship to Australia and a range of international locations including: Belgium, Canada, China, Switzerland, Czechia, Germany, Denmark, Spain, Finland, France, United Kingdom, United States, Hong Kong SAR, Thailand, Philippines, Ireland, Israel, Italy, Japan, South Korea, Malaysia, Netherlands, Norway, Poland, Portugal, Sweden & Singapore. If your country is not listed, we may not be able to ship to you, or may only offer a quoting shipping option, please contact us if you are unsure.

International orders normally arrive within 2-4 weeks of shipping. Please note that these orders need to pass through the customs office in your country before it will be released for final delivery, which can occasionally cause additional delays. Once an order leaves our warehouse, carrier shipping delays may occur due to factors outside our control. We, unfortunately, can’t control how quickly an order arrives once it has left our warehouse. Contacting the carrier is the best way to get more insight into your package’s location and estimated delivery date.

- Global Standard 1 Book Rate: $37 + $10 for every extra book up to 20kg

- Australia Standard 1 Book Rate: $14 + $4 for every extra book

Any parcels with a combined weight of over 20kg will not process automatically on the website and you will need to contact us for a quote.

Payment Options

On checkout you can either opt to pay by credit card (Visa, Mastercard or American Express), Google Pay, Apple Pay, Shop Pay & Union Pay. Paypal, Afterpay and Bank Deposit.

Transactions are processed immediately and in most cases your order will be shipped the next working day. We do not deliver weekends sorry.

If you do need to contact us about an order please do so here.

You can also check your order by logging in.

Contact Details

- Trade Name: Book Express Ltd

- Phone Number: (+64) 22 852 6879

- Email: sales@bookexpress.co.nz

- Address: 62 Kaiwharawhara Rd, Kaiwharawhara, Wellington, 6035, New Zealand.

- GST Number: 103320957 - We are registered for GST in New Zealand

- NZBN: 9429031911290

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return.

To be eligible for a return, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

To start a return, you can contact us at sales@bookexpress.co.nz. Please note that returns will need to be sent to the following address: 62 Kaiwharawhara Road, Wellington, NZ once we have confirmed your return.

If your return is accepted, we’ll send you a return shipping label, as well as instructions on how and where to send your package. Items sent back to us without first requesting a return will not be accepted.

You can always contact us for any return question at sales@bookexpress.co.nz.

Damages and issues

Please inspect your order upon reception and contact us immediately if the item is defective, damaged or if you receive the wrong item, so that we can evaluate the issue and make it right.

Exceptions / non-returnable items

Certain types of items cannot be returned, like perishable goods (such as food, flowers, or plants), custom products (such as special orders or personalized items), and personal care goods (such as beauty products). We also do not accept returns for hazardous materials, flammable liquids, or gases. Please get in touch if you have questions or concerns about your specific item.

Unfortunately, we cannot accept returns on sale items or gift cards.

Exchanges

The fastest way to ensure you get what you want is to return the item you have, and once the return is accepted, make a separate purchase for the new item.

European Union 14 day cooling off period

Notwithstanding the above, if the merchandise is being shipped into the European Union, you have the right to cancel or return your order within 14 days, for any reason and without a justification. As above, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

Refunds

We will notify you once we’ve received and inspected your return, and let you know if the refund was approved or not. If approved, you’ll be automatically refunded on your original payment method within 10 business days. Please remember it can take some time for your bank or credit card company to process and post the refund too.

If more than 15 business days have passed since we’ve approved your return, please contact us at sales@bookexpress.co.nz.