Damodaran on Valuation: Security Analysis for Investment and Corporate Finance by Aswath Damodaran

Damondaran on Valuation will not only convince you of the vitality of the many valuation models available to you, it will help ensure that you develop the acumen needed to select the right model for any valuation scenario. Written by a gifted teacher and respected valuation authority, Damodaran on Valuation offers systematic examination of the three basic approaches to valuation - discounted cash-flow valuation, relative valuation, and contingent claim valuation - and the various models within these broad categories. Using numerous real-world examples involving both US and International firms, the book illuminates the purpose of each particular model, its advantages and limitatations, the step-by-step process involved in putting the model to work, and the kinds of firms to which it is best applied. Among the tools presented are designed to: * Estimate the cost of equity - including the capital asset pricing model and arbitrage pricing model * Estimate growth rates - with coverage of how to arrive at a weighted average of growth rates by blending three separate approaches * Value equity - focusing on the Gordon Growth Model and the two-and three-stage dividend discount model * Measure free cash flow to equity - cash flows that are carefully delineated from the dividends of most firms * Value firms - including free cash flow to firm models, which are especially suited to highly leveraged firms * Estimate the value of assets by looking at the pricing of comparable assets - with insight into the use and misuse of price/earning and price/book value ratios, and underutilized price-to-sales ratios * Measure the value of assets that share option characteristics - including a comparative look at the classic Black-Scholes and simpler binomial models. Supported by an optional IBM-compatible disk, which consists of spreadsheet programs designed to help users apply the models highlighted in the book, Damodaran on Valuation provides practitioners involved in securities analysis, portfolio management, M&A, and corporate finance with the knowledge they need to value any asset. Editorial Reviews From the Back Cover Pick the right model for the right moment every time. Whatever your investment philosophy and goals, you've probably had trouble at one time or another in measuring the value of a particular asset. Maybe you've been wary of the effectiveness of all the valuation models out there and relied on the guesstimate approach or simply picked the wrong model for the asset under consideration. Whatever past problems you may have encountered, Damodaran on Valuation will not only convince you of the vitality of the many valuation models available to you, it will help ensure that you develop the acumen needed to select the right model for any valuation scenario. Written by a gifted teacher and respected valuation authority, Damodaran on Valuation offers an overview of the three basic valuation approaches-discounted cash flow, relative, and contingent claim valuation-and the models within these classes. Using plenty of real-world case studies, it explains the purpose of each model, its pros and cons, the steps involved in applying it, and the types of firms to which it is most suited. Soon, you'll have a solid, practical grasp of tools designed to help you estimate the cost of equity, estimate growth rates, value equity, measure free cash flows to equity, value firms, estimate the value of assets via pricing of comparable assets, and measure the value of assets with option-like characteristics. No model is foolproof. And every valuation is vulnerable to changes in the environment, the economy, and the asset itself. But with Damodaran on Valuation at your side, you can be certain that you'll have every weapon at your disposal in the battle to accurately determine the value of an asset and to make the right financial decisions under pressure.

Overview

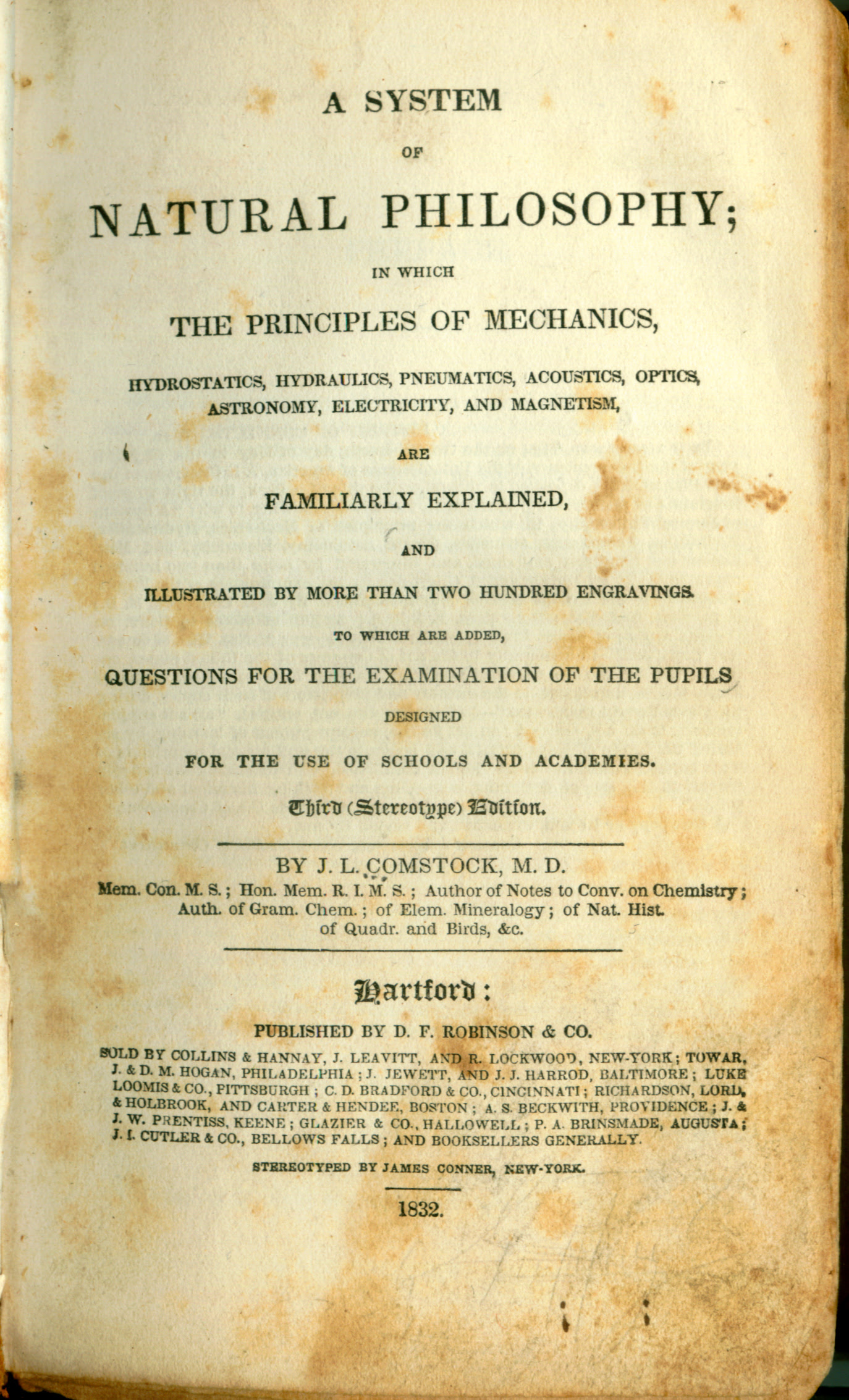

Title: Damodaran on Valuation: Security Analysis for Investment and Corporate Finance by Aswath Damodaran

Author: Aswath Damodaran

Book Cover Type:

Pages: 464

Language: ENG- English

Condition

Publisher

Publishers: Wiley

Location:

Year: 1994

Pages:

Illustrators

Edition

Dimensions

6.22 x 1.38 x 9.51 inches

Pickup currently unavailable at Book Express Warehouse

Product information

New Zealand Delivery

Shipping Options

Shipping options are shown at checkout and will vary depending on the delivery address and weight of the books.

We endeavour to ship the following day after your order is made and to have pick up orders available the same day. We ship Monday-Friday. Any orders made on a Friday afternoon will be sent the following Monday. We are unable to deliver on Saturday and Sunday.

Pick Up is Available in NZ:

Warehouse Pick Up Hours

- Monday - Friday: 9am-5pm

- 62 Kaiwharawhara Road, Wellington, NZ

Please make sure we have confirmed your order is ready for pickup and bring your confirmation email with you.

Rates

-

New Zealand Standard Shipping - $6.00

- New Zealand Standard Rural Shipping - $10.00

- Free Nationwide Standard Shipping on all Orders $75+

Please allow up to 5 working days for your order to arrive within New Zealand before contacting us about a late delivery. We use NZ Post and the tracking details will be emailed to you as soon as they become available. Due to Covid-19 there have been some courier delays that are out of our control.

International Delivery

We currently ship to Australia and a range of international locations including: Belgium, Canada, China, Switzerland, Czechia, Germany, Denmark, Spain, Finland, France, United Kingdom, United States, Hong Kong SAR, Thailand, Philippines, Ireland, Israel, Italy, Japan, South Korea, Malaysia, Netherlands, Norway, Poland, Portugal, Sweden & Singapore. If your country is not listed, we may not be able to ship to you, or may only offer a quoting shipping option, please contact us if you are unsure.

International orders normally arrive within 2-4 weeks of shipping. Please note that these orders need to pass through the customs office in your country before it will be released for final delivery, which can occasionally cause additional delays. Once an order leaves our warehouse, carrier shipping delays may occur due to factors outside our control. We, unfortunately, can’t control how quickly an order arrives once it has left our warehouse. Contacting the carrier is the best way to get more insight into your package’s location and estimated delivery date.

- Global Standard 1 Book Rate: $37 + $10 for every extra book up to 20kg

- Australia Standard 1 Book Rate: $14 + $4 for every extra book

Any parcels with a combined weight of over 20kg will not process automatically on the website and you will need to contact us for a quote.

Payment Options

On checkout you can either opt to pay by credit card (Visa, Mastercard or American Express), Google Pay, Apple Pay, Shop Pay & Union Pay. Paypal, Afterpay and Bank Deposit.

Transactions are processed immediately and in most cases your order will be shipped the next working day. We do not deliver weekends sorry.

If you do need to contact us about an order please do so here.

You can also check your order by logging in.

Contact Details

- Trade Name: Book Express Ltd

- Phone Number: (+64) 22 852 6879

- Email: sales@bookexpress.co.nz

- Address: 62 Kaiwharawhara Rd, Kaiwharawhara, Wellington, 6035, New Zealand.

- GST Number: 103320957 - We are registered for GST in New Zealand

- NZBN: 9429031911290

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return.

To be eligible for a return, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

To start a return, you can contact us at sales@bookexpress.co.nz. Please note that returns will need to be sent to the following address: 62 Kaiwharawhara Road, Wellington, NZ once we have confirmed your return.

If your return is accepted, we’ll send you a return shipping label, as well as instructions on how and where to send your package. Items sent back to us without first requesting a return will not be accepted.

You can always contact us for any return question at sales@bookexpress.co.nz.

Damages and issues

Please inspect your order upon reception and contact us immediately if the item is defective, damaged or if you receive the wrong item, so that we can evaluate the issue and make it right.

Exceptions / non-returnable items

Certain types of items cannot be returned, like perishable goods (such as food, flowers, or plants), custom products (such as special orders or personalized items), and personal care goods (such as beauty products). We also do not accept returns for hazardous materials, flammable liquids, or gases. Please get in touch if you have questions or concerns about your specific item.

Unfortunately, we cannot accept returns on sale items or gift cards.

Exchanges

The fastest way to ensure you get what you want is to return the item you have, and once the return is accepted, make a separate purchase for the new item.

European Union 14 day cooling off period

Notwithstanding the above, if the merchandise is being shipped into the European Union, you have the right to cancel or return your order within 14 days, for any reason and without a justification. As above, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

Refunds

We will notify you once we’ve received and inspected your return, and let you know if the refund was approved or not. If approved, you’ll be automatically refunded on your original payment method within 10 business days. Please remember it can take some time for your bank or credit card company to process and post the refund too.

If more than 15 business days have passed since we’ve approved your return, please contact us at sales@bookexpress.co.nz.