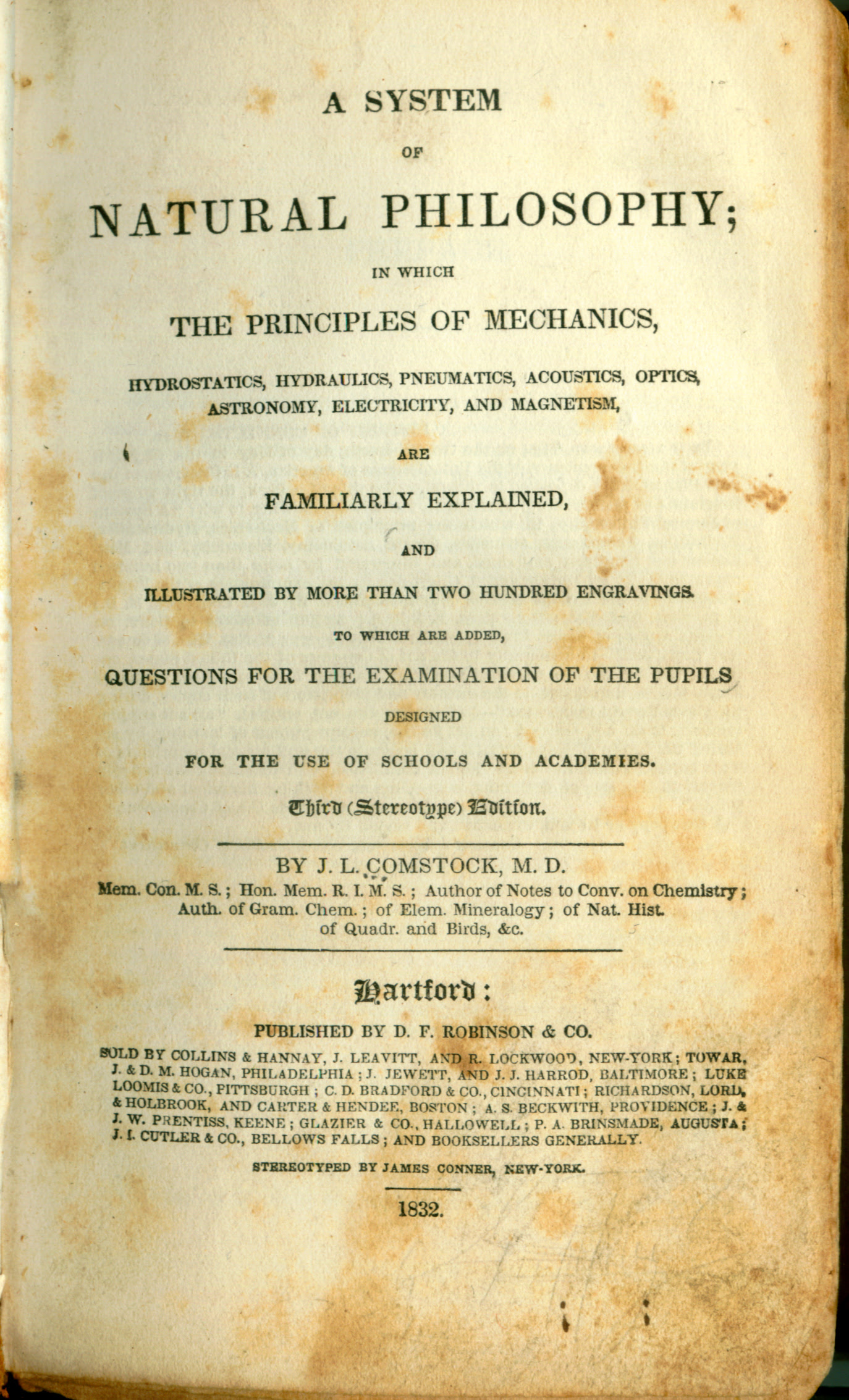

Corporate Financial Distress and Bankruptcy: A Complete Guide to Predicting & Avoiding Distress and Profiting from Bankruptcy (Wiley Finance) by Edward I. Altman

Predict, Avoid, Manage-and Even Profit From-Bankruptcy With this new Second Edition of the first definitive guide This new edition of the premier business failure, insolvency, default, and bankruptcy guide provides financial professionals of every stripe with a master reference to the latest banking, credit, investment, legal, financial, and management thought and practice. To help readers combat corporate distress in the ?90s and beyond, distinguished author Edward I. Altman includes coverage of... Unique statistical tools-author-developed techniques for assessing firms? distress potential, measuring debt price movements, benchmarking debt investor and market performance, establishing the present value of loans, and so much more. Junk bonds-Altman revisits this market to provide an in-depth analysis of the role and risk-return trade-offs of this controversial source of finance Emerging trends-complete explorations of debtor-in-possession lending, prepackaged bankruptcy, and the epidemic of fraudulent conveyance suits resulting from ill-conceived restructurings An evaluation of the Chapter 11 process, now under public scrutiny and criticism Bankruptcy reorganization case histories-real-world data to help readers carry out debtor valuation analyses and restructurings, featuring Duplan Corporation and Wheeling Pittsburgh Steel Corporation With this wealth of authoritative information and practical guidelines, bankruptcy creditors, debtors, investors, and third party professionals will have everything they need to predict, avoid, manage, and profit from corporate distress. Corporate Financial Distress and Bankruptcy is an excellent analysis of an increasingly important topic. Professor Altman is the premier scholar in this area, and this book is a fitting reflection of that scholarship. -Ben Branch, Trustee Bank of New England Corporation Professor of Finance, University of Massachusetts Corporate Financial Distress and Bankruptcy is an indispensable resource for all who are interested in bankruptcy. Ed Altman has collected, in a single volume, the history, legislative facts, statistics and analytic methods that I search for time and time again. This book is outstandingly comprehensive and up-to-date. -Martin S. Fridson, Managing Director Securities Research and Economics, High Yield Research Group Merrill Lynch Editorial Reviews From the Publisher Updated and revised to reflect the changing atmosphere in corporate America, this edition offers a comprehensive treatment regarding a variety of topics on the distressed firm. Contains new models which analyze corporations and techniques to assess financial options. Features a new chapter on the junk bonds markets. Current case studies have been added to the bankruptcy chapters, allowing readers to work through typical analysis of corporate financial position and plan future strategies. From the Inside Flap Olympia & York and Maxwell Communications...Executive Life Insurance and Mutual Benefit Life...Campeau and Macy?s...Continental Airlines and TWA. The number of billion-dollar-plus firms filing for bankruptcy in the 1981 to 1983 recession was seven. Thirty-three filed from 1988 to 1992! Predicting, avoiding, managing, and profiting from corporate distress has never been bigger business. Leading international authority Edward I. Altman?s Second Edition of Corporate Financial Distress and Bankruptcy describes a vast range of tools and techniques for anticipating financial crisis...managing turnarounds...and dealing with the complex legal, accounting, and investment consequences of bankruptcy. You?ll find updated information on... Distressed firm investing-a unique, author-developed index that measures defaulted debt price movements and bench-marks market and investor performance Distress assessment-a range of robust and practical statistical models for classifying and assessing the distress potential of firms Credit assessment-a powerful statistical framework for bank loan valuation that establishes criteria for loan or investment loss reserves and even gives pricing guidelines for the commercial loan provider Present value assessment-an innovative technique for deriving the present value of loans that enables banks to keep up with accounting standards that require assets and liabilities to be marked at market or fair values Turnaround techniques-how to apply this book?s failure prediction models to help corporations return to financial health, including an illustrative case history featuring the GTI Corporation Literature review-throughout the book, the author evaluates the latest scholarly investigations into theoretical, empirical, and normative issues surrounding distressed firms International dimension-a bibliography of failure prediction models applied outside the U.S. with a large number of industrialized and even third-world economy examples If the bankruptcy business is booming-and a record number of defaults in 1991 suggests it surely is-then this new edition of Corporate Financial Distress and Bankruptcy is the best business news for quite some time. About the Author About the author EDWARD I. ALTMAN is a world-recognized expert on corporate bankruptcy and credit analysis. He served as an advisor to the U.S. Commission on Revision of the Bankruptcy Act and his books Corporate Bankruptcy in America and Corporate Financial Distress are considered landmarks in the field. Dr. Altman is Max L. Heine Professor of Finance at New York University?s Leonard N. Stern School of Business. He has edited John Wiley & Sons? Professional Banking and Finance Series, Handbook of Corporate Finance, Financial Handbook, and Handbook of Financial Markets and Institutions, and is the coauthor of Investing in Junk Bonds (with Scott A. Nammacher).

Overview

Title: Corporate Financial Distress and Bankruptcy: A Complete Guide to Predicting & Avoiding Distress and Profiting from Bankruptcy (Wiley Finance) by Edward I. Altman

Author: Edward I. Altman

Book Cover Type:

Pages: 384

Language: ENG- English

Condition

Publisher

Publishers: Wiley

Location:

Year: 1993

Pages:

Illustrators

Edition

Dimensions

6.34 x 1.21 x 9.35 inches

Pickup currently unavailable at Book Express Warehouse

Product information

New Zealand Delivery

Shipping Options

Shipping options are shown at checkout and will vary depending on the delivery address and weight of the books.

We endeavour to ship the following day after your order is made and to have pick up orders available the same day. We ship Monday-Friday. Any orders made on a Friday afternoon will be sent the following Monday. We are unable to deliver on Saturday and Sunday.

Pick Up is Available in NZ:

Warehouse Pick Up Hours

- Monday - Friday: 9am-5pm

- 62 Kaiwharawhara Road, Wellington, NZ

Please make sure we have confirmed your order is ready for pickup and bring your confirmation email with you.

Rates

-

New Zealand Standard Shipping - $6.00

- New Zealand Standard Rural Shipping - $10.00

- Free Nationwide Standard Shipping on all Orders $75+

Please allow up to 5 working days for your order to arrive within New Zealand before contacting us about a late delivery. We use NZ Post and the tracking details will be emailed to you as soon as they become available. Due to Covid-19 there have been some courier delays that are out of our control.

International Delivery

We currently ship to Australia and a range of international locations including: Belgium, Canada, China, Switzerland, Czechia, Germany, Denmark, Spain, Finland, France, United Kingdom, United States, Hong Kong SAR, Thailand, Philippines, Ireland, Israel, Italy, Japan, South Korea, Malaysia, Netherlands, Norway, Poland, Portugal, Sweden & Singapore. If your country is not listed, we may not be able to ship to you, or may only offer a quoting shipping option, please contact us if you are unsure.

International orders normally arrive within 2-4 weeks of shipping. Please note that these orders need to pass through the customs office in your country before it will be released for final delivery, which can occasionally cause additional delays. Once an order leaves our warehouse, carrier shipping delays may occur due to factors outside our control. We, unfortunately, can’t control how quickly an order arrives once it has left our warehouse. Contacting the carrier is the best way to get more insight into your package’s location and estimated delivery date.

- Global Standard 1 Book Rate: $37 + $10 for every extra book up to 20kg

- Australia Standard 1 Book Rate: $14 + $4 for every extra book

Any parcels with a combined weight of over 20kg will not process automatically on the website and you will need to contact us for a quote.

Payment Options

On checkout you can either opt to pay by credit card (Visa, Mastercard or American Express), Google Pay, Apple Pay, Shop Pay & Union Pay. Paypal, Afterpay and Bank Deposit.

Transactions are processed immediately and in most cases your order will be shipped the next working day. We do not deliver weekends sorry.

If you do need to contact us about an order please do so here.

You can also check your order by logging in.

Contact Details

- Trade Name: Book Express Ltd

- Phone Number: (+64) 22 852 6879

- Email: sales@bookexpress.co.nz

- Address: 62 Kaiwharawhara Rd, Kaiwharawhara, Wellington, 6035, New Zealand.

- GST Number: 103320957 - We are registered for GST in New Zealand

- NZBN: 9429031911290

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return.

To be eligible for a return, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

To start a return, you can contact us at sales@bookexpress.co.nz. Please note that returns will need to be sent to the following address: 62 Kaiwharawhara Road, Wellington, NZ once we have confirmed your return.

If your return is accepted, we’ll send you a return shipping label, as well as instructions on how and where to send your package. Items sent back to us without first requesting a return will not be accepted.

You can always contact us for any return question at sales@bookexpress.co.nz.

Damages and issues

Please inspect your order upon reception and contact us immediately if the item is defective, damaged or if you receive the wrong item, so that we can evaluate the issue and make it right.

Exceptions / non-returnable items

Certain types of items cannot be returned, like perishable goods (such as food, flowers, or plants), custom products (such as special orders or personalized items), and personal care goods (such as beauty products). We also do not accept returns for hazardous materials, flammable liquids, or gases. Please get in touch if you have questions or concerns about your specific item.

Unfortunately, we cannot accept returns on sale items or gift cards.

Exchanges

The fastest way to ensure you get what you want is to return the item you have, and once the return is accepted, make a separate purchase for the new item.

European Union 14 day cooling off period

Notwithstanding the above, if the merchandise is being shipped into the European Union, you have the right to cancel or return your order within 14 days, for any reason and without a justification. As above, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

Refunds

We will notify you once we’ve received and inspected your return, and let you know if the refund was approved or not. If approved, you’ll be automatically refunded on your original payment method within 10 business days. Please remember it can take some time for your bank or credit card company to process and post the refund too.

If more than 15 business days have passed since we’ve approved your return, please contact us at sales@bookexpress.co.nz.