The Undercover Economist by Tim Harford

The economy [isn't] a bunch of rather dull statistics with names like GDP (gross domestic product), notes Tim Harford, columnist and regular guest on NPR's Marketplace, economics is about who gets what and why. In this acclaimed and riveting book-part expos? part user's manual-the astute and entertaining columnist from the Financial Times demystifies the ways in which money works in the world. From why the coffee in your cup costs so much to why efficiency is not necessarily the answer to ensuring a fair society, from improving health care to curing crosstown traffic-all the dirty little secrets of dollars and cents are delightfully revealed by The Undercover Economist. A rare specimen: a book on economics that will enthrall its readers . . . It brings the power of economics to life. -Steven D. Levitt, coauthor of Freakonomics A playful guide to the economics of everyday life, and as such is something of an elder sibling to Steven Levitt's wild child, the hugely successful Freakonomics. -The Economist A tour de force . . . If you need to be convinced of the everrelevant and fascinating nature of economics, read this insightful and witty book. -Jagdish Bhagwati, author of In Defense of Globalization This is a book to savor. -The New York Times Harford writes like a dream. From his book I found out why there's a Starbucks on every corner [and] how not to get duped in an auction. Reading The Undercover Economist is like spending an ordinary day wearing X-ray goggles. -David Bodanis, author of Electric Universe Much wit and wisdom. -The Houston Chronicle From Publishers Weekly Nattily packaged-the cover sports a Roy Lichtensteinesque image of an economist in Dick Tracy garb-and cleverly written, this book applies basic economic theory to such modern phenomena as Starbucks' pricing system and Microsoft's stock values. While the concepts explored are those encountered in Microeconomics 101, Harford gracefully explains abstruse ideas like pricing along the demand curve and game theory using real world examples without relying on graphs or jargon. The book addresses free market economic theory, but Harford is not a complete apologist for capitalism; he shows how companies from Amazon.com to Whole Foods to Starbucks have gouged consumers through guerrilla pricing techniques and explains the high rents in London (it has more to do with agriculture than one might think). Harford comes down soft on Chinese sweatshops, acknowledging conditions in factories are terrible, but sweatshops are better than the horrors that came before them, and a step on the road to something better. Perhaps, but Harford doesn't question whether communism or a capitalist-style industrial revolution are the only two choices available in modern economies. That aside, the book is unequaled in its accessibility and ability to show how free market economic forces affect readers' day-to-day. Copyright ? Reed Business Information, a division of Reed Elsevier Inc. All rights reserved. From Bookmarks Magazine Harford exposes the dark underbelly of capitalism in Undercover Economist. Compared with Steven Levitt's and Stephen J. Dubner's popular Freakonomics (*** July/Aug 2005), the book uses simple, playful examples (written in plain English) to elucidate complex economic theories. Critics agree that the book will grip readers interested in understanding free-market forces but disagree about Harford's approach. Some thought the author mastered the small ideas while keeping in sight the larger context of globalization; others faulted Harford for failing to criticize certain economic theories and to ground his arguments in political, organizational structures. Either way, his case studies-some entertaining, others indicative of times to come-will make you think twice about that cup of coffee. Copyright ? 2004 Phillips & Nelson Media, Inc. Editorial Reviews From Publishers Weekly Nattily packaged-the cover sports a Roy Lichtensteinesque image of an economist in Dick Tracy garb-and cleverly written, this book applies basic economic theory to such modern phenomena as Starbucks' pricing system and Microsoft's stock values. While the concepts explored are those encountered in Microeconomics 101, Harford gracefully explains abstruse ideas like pricing along the demand curve and game theory using real world examples without relying on graphs or jargon. The book addresses free market economic theory, but Harford is not a complete apologist for capitalism; he shows how companies from Amazon.com to Whole Foods to Starbucks have gouged consumers through guerrilla pricing techniques and explains the high rents in London (it has more to do with agriculture than one might think). Harford comes down soft on Chinese sweatshops, acknowledging conditions in factories are terrible, but sweatshops are better than the horrors that came before them, and a step on the road to something better. Perhaps, but Harford doesn't question whether communism or a capitalist-style industrial revolution are the only two choices available in modern economies. That aside, the book is unequaled in its accessibility and ability to show how free market economic forces affect readers' day-to-day. Copyright ? Reed Business Information, a division of Reed Elsevier Inc. All rights reserved. From the Back Cover The Undercover Economist is a rare specimen: a book on economics that will enthrall its readers. Beautifully written and argued, it brings the power of economics to life. This book should be required reading for every elected official, business leader, and university student. --Steven D. Levitt, author of Freakonomics: A Rogue Economist Explores the Hidden Side of Everything Harford writes like a dream--and is also one of the leading economic thinkers of his generation. From his book I found out why there's a Starbucks on every corner, what Bob Geldof needs to learn to make development aid work properly, and how not to get duped in an auction. Reading The Undercover Economist is like spending an ordinary day wearing X-ray goggles. --David Bodanis, author of E=mc2 and Electric Universe If you need to be convinced of the ever-relevant and fascinating nature of economics, read this insightful and witty book by Tim Harford. Using one interesting example after another, The Undercover Economist demonstrates how economic reasoning -- often esoteric and dull, but totally accessible in Harford's hands -- helps illuminate the world around us. Indeed, Harford's book is a tour de force. --Jagdish Bhagwati, author of In Defense of Globalization As Tim Harford demonstrates brilliantly in this enjoyable book, the powerful underlying ideas of economics can, in the hands of the right person, illuminate every aspect of the world we inhabit. --Martin Wolf, Associate Editor and Chief Economics Commentator, Financial Times, and author of Why Globalization Works Most people think economists are boring, opinionated and wrong. Tim Harford is often right, always opinionated, but never boring. He shows how economics can be used to illuminate our everyday lives. Whether you want an explanation of the price of a cup of coffee or of poverty in the third world, Harford has it all. --John Kay, author of Culture and Prosperity: The Truth About Markets About the Author Tim Harford is an editorial writer at the Financial Times, where he also writes the newspaper's Dear Economist column and The Undercover Economist column, which also appears in Slate. He lives in London. About the Author Tim Harford is an editorial writer at the Financial Times, where he also writes the newspaper's Dear Economist column and The Undercover Economist column, which also appears in Slate. He lives in London. Review Required reading. -Steven Levitt, author of Freakonomics A playful guide to the economics of everyday life, and as such. . . something of an elder sibling to Steven Levitt's wild child, the hugely successful Freakonomics. -The Economist A book to savor. -The New York Times The Undercover Economist is a book you must pick up if you want a fresh perspective on how basic ideas in economics can help in answering the most complex and perplexing questions about the world around us. -Business Today [Harford] is in every sense consumer-friendly. His chapters come in bite-size sections, with wacky sub-headings. His style is breezy and no-nonsense. . . . The Undercover Economistis part primer, part consciousness raiser, part self-help manual. --Times Literary Supplement Anyone mystified by how the world works will benefit from this book - especially anyone confused about why good intentions don't, necessarily, translate into good results. -The Daily Telegraph (UK) Harford writes like a dream - and is also one of the leading economic thinkers of his generation. From his book I found out why there's a Starbucks on every corner, what Bob Geldof needs to learn to make development aid work properly, and how not to get duped in an auction. Reading The Undercover Economist is like spending an ordinary day wearing X-ray goggles. -David Bodanis, author of E=mc2 and Electric Universe Popular economics is not an oxymoron, and here is the proof. This book, by the Financial Times columnist Tim Harford, is as lively and witty an introduction to the supposedly 'dismal science' as you are likely to read. -The Times From AudioFile This delightful behind-the-scenes look at basic economics should be required listening for anyone who's looked up at a Starbucks menu and asked, Why am I paying four dollars for a cup of coffee? Robert McKenzie reads with an educated English accent that entertains as well as enchants, and he makes a point to be both clear and challenging in his delivery. The author's take on money is laugh-out-loud funny, and listeners who tune in for the entertainment value will find themselves educated in the ways of the economic world. Magnificently written and read, this book solves some of the mysteries of everyday life with wit and style. R.O. ? AudioFile 2006, Portland, Maine-- Copyright ? AudioFile, Portland, Maine Excerpt. ? Reprinted by permission. All rights reserved. One Who Pays for Your Coffee? The long commute on public transportation is a commonplace experience of life in major cities around the world, whether you live in New York, Tokyo, Antwerp, or Prague. Commuting dispiritingly combines the universal and the particular. The particular, because each commuter is a rat in his own unique maze: timing the run from the shower to the station turnstiles; learning the timetables and the correct end of the platform to speed up the transfer between different trains; trading off the disadvantages of standing room only on the first train home against a seat on the last one. Yet commutes also produce common patterns-bottlenecks and rush hours-that are exploited by entrepreneurs the world over. My commute in Washington, D.C., is not the same as yours in London, New York, or Hong Kong, but it will look surprisingly familiar. Farragut West is the Metro station ideally positioned to serve the World Bank, International Monetary Fund, and even the White House. Every morning, sleep-deprived, irritable travelers surface from Farragut West into the International Square plaza, and they are not easily turned aside from their paths. They want to get out of the noise and bustle, around the shuffling tourists, and to their desks just slightly before their bosses. They do not welcome detours. But there is a place of peace and bounty that can tempt them to tarry for a couple of minutes. In this oasis, rare delights are served with smiles by attractive and exotic men and women-today, a charming barista whose name badge reads Maria. I am thinking, of course, of Starbucks. The caf?is placed, inescapably, at the exit to International Square. This is no quirk of Farragut West: the first storefront you will pass on your way out of the nearby Farragut North Metro is-another Starbucks. You find such conveniently located coffee shops all over the planet and catering to the same desperate commuters. The coffee shop within ten yards of the exit from Washington's Dupont Circle Metro station is called Cosi. New York's Penn Station boasts Seattle Coffee Roasters just by the exit to Eighth Avenue. Commuters through Shinjuku Station, Tokyo, can enjoy a Starbucks without leaving the station concourse. In London's Waterloo station, it is the AMT kiosk that guards the exit onto the south bank of the Thames. At $2.55 a tall cappuccino from Starbucks is hardly cheap. But of course, I can afford it. Like many of the people stopping at that caf? I earn the price of that coffee every few minutes. None of us care to waste our time trying to save a few pennies by searching out a cheaper coffee at 8:30 in the morning. There is a huge demand for the most convenient coffee possible-in Waterloo Station, for example, seventy-four million people pass through each year. That makes the location of the coffee bar crucial. The position of the Starbucks caf?at Farragut West is advantageous, not just because it's located on an efficient route from the platforms to the station exit, but because there are no other coffee bars on that route. It's hardly a surprise that they do a roaring trade. If you buy as much coffee as I do you may have come to the conclusion that somebody is getting filthy rich out of all this. If the occasional gripes in the newspapers are correct, the coffee in that cappuccino costs pennies. Of course, the newspapers don't tell us the whole story: there's milk, electricity, cost of the paper cups-and the cost of paying Maria to smile at grouchy customers all day long. But after you add all that up you still get something a lot less than the price of a cup of coffee. According to economics professor Brian McManus, markups on coffee are around 150 percent-it costs forty cents to make a one-dollar cup of drip coffee and costs less than a dollar for a small latte, which sells for $2.55. So somebody is making a lot of money. Who? You might think that the obvious candidate is Howard Schultz, the owner of Starbucks. But the answer isn't as simple as that. The main reason that Starbucks can ask $2.55 for a cappuccino is that there isn't a shop next door charging $2.00. So why is nobody next door undercutting Starbucks? Without wishing to dismiss the achievements of Mr. Schultz, cappuccinos are not in fact complicated products. There is no shortage of drinkable cappuccinos (sadly, there is no shortage of undrinkable cappuccinos either). It doesn't take much to buy some coffee machines and a counter, build up a brand with a bit of adver- tising and some free samples, and hire decent staff. Even Maria is replaceable. The truth is that Starbucks' most significant advantage is its location on the desire line of thousands of commuters. There are a few sweet spots for coffee bars-by station exits or busy street corners. Starbucks and its rivals have snapped them up. If Starbucks really did have the hypnotic hold over its customers that critics complain about, it would hardly need to spend so much effort getting people to trip over its caf?. The nice margin that Starbucks makes on their cappuccinos is due neither to the quality of the coffee nor to the staff: it's location, location, location. But who controls the location? Look ahead to the negotiations for the new rental agreement. The landlord at International Square will not only be talking to Starbucks but to other chains like Cosi and Caribou Coffee, and D.C.'s local companies: Java House, Swing's, Capitol Grounds, and Teaism. The landlord can sign an agreement with each one of them or can sign an exclusive agreement with only one. She'll quickly find that nobody is very eager to pay much for a space next to ten other coffee bars, and so she will get the most advantage out of the exclusive agreement. In trying to work out who is going to make all the money, simply remember that there are at least half a dozen competing companies on one side of the negotiating table and on the other side is a landlord who owns a single prime coffee-bar site. By playing them off against each other, the landlord should be able to dictate the terms and force one of them to pay rent, which consumes almost all their expected profits. The successful company will expect some profit but not much: if the rent looks low enough to leave a substantial profit, another coffee bar will be happy to pay a little extra for the site. There is an unlimited number of potential coffee bars and a limited number of attractive sites-and that means the landlords have the upper hand. This is pure armchair reasoning. It's reasonable to ask if all of this is actually true. After I explained to a long-suffering friend (over coffee) all of the principles involved, she asked me whether I could prove it. I admitted that it was just a theory-as Sherlock Holmes might say, a piece of observation and deduction, based on clues available to all of us. A couple of weeks later she sent me an article from the Financial Times, which relied on industry experts who had access to the accounts of coffee companies. The article began, Few companies are making any money and concluded that one of the main problems was the high costs of running retail outlets in prime locations with significant passing trade. Reading accounts is dull; economic detective work is the easy way to get to the same conclusion. Strength from scarcity Browsing through the old economics books on the shelf at home, I dug out the first analysis of twenty-first-century coffee bars. Published in 1817, it explains not just the modern coffee bar but much of the modern world itself. Its author, David Ricardo, had already made himself a multimillionaire (in today's money) as a stockbroker, and was later to become a Member of Parliament. But Ricardo was also an enthusiastic economist, who longed to understand what had happened to Britain's economy during the then-recent Napoleonic wars: the price of wheat had rocketed, and so had rents on agricultural land. Ricardo wanted to know why. The easiest way to understand Ricardo's analysis is to use one of his own examples. Imagine a wild frontier with few settlers but plenty of fertile meadow available for growing crops. One day an aspiring young farmer, Axel, walks into town and offers to pay rent for the right to grow crops on an acre of good meadow. Everyone agrees how much grain an acre of meadow will produce, but they cannot decide how much rent Axel should pay. Because there is no shortage of land lying fallow, competing landlords will not be able to charge a high rent . . . or any significant rent at all. Each landlord would rather collect a small rent than no rent at all, and so each will undercut his rivals until Axel is able to start farming for very little rent-just enough to compensate for the landlord's trouble. The first lesson here is that the person in possession of the desired resource-the landlord in this case-does not always have as much power as one would assume. And the story doesn't specify whether Axel is very poor or has a roll of cash in the false heel of his walking boot, because it doesn't make any difference to the rent. Bargaining strength comes through scarcity: settlers are scarce and meadows are not, so landlords have no bargaining power. That means that if relative scarcity shifts from one person to another, bargaining shifts as well. If over the years many immigrants follow in Axel's footsteps, the amount of spare meadowland will shrink until there is none left. As long as there is any, competition between landlords who have not attracted any tenants will keep rents very low. One day, however, an aspiring farmer will walk into town-let's call him Bob-and will find that there is no spare fertile land. The alternative, farming on inferior but abundant scrubland, is not attractive. So Bob will offer to pay good money to any landlord who will evict Axel, or any of the other farmers currently farming virtually rent-free, and let him farm there instead. But just as Bob is willing to pay to rent meadowland rather than scrubland, all of the meadow farmers will also be willing to pay not to move. Everything has changed, and quickly: suddenly the landlords have acquired real bargaining power, because suddenly farmers are relatively common and meadows are relatively scarce. That means the landowners will be able to raise their rents. By how much? It will have to be enough that farmers earn the same farming on meadows and paying rent, or farming on inferior scrubland rent free. If the difference in productiveness of the two types of land is five bushels of grain a year, then the rent will also be five bushels a year. If a landlord tries to charge more, his tenant will leave to farm scrubland. If the rent is any less, the scrub farmer would be willing to offer more. It may seem odd that the rents changed so rapidly simply because one more man arrived to farm the area. This story doesn't seem to explain how the world really works. But there is more truth to it than you might think, even if it is oversimplified. Of course, in the real world, there are other elements to consider: laws about evicting people, long-term contracts, and even cultural norms, such as the fact that kicking one person out and installing a new tenant the next day is just not done. In the real world there are more than two types of farmland, and Bob may have different options to being a farmer-he may be able to get a job as an accountant or driving a cab. All these facts complicate what happens in reality; they slow down the shift in bargaining power, alter the absolute numbers involved, and put a brake on sudden movements in rents. Yet the complications of everyday life often hide the larger trends behind the scenes, as scarcity power shifts from one group to another. The economist's job is to shine a spotlight on the underlying process. We should not be surprised if, suddenly, the land market shifts against farmers; or if house prices go up dramatically; or if the world is covered by coffee bars over a period of just a few months. The simplicity of the story emphasizes one part of the underlying reality-but the emphasis is helpful in revealing something important. Sometimes relative scarcity and bargaining strength really do change quickly, and with profound effects on people's lives. We often complain about symptoms-the high cost of buying a cup of coffee, or even a house. The symptoms cannot be treated successfully without understanding the patterns of scarcity which underlie them. Marginal land is of central importance The shifts in bargaining power don't have to stop there. While the farming story can be elaborated indefinitely, the basic principles remain the same. For example, if new farmers keep arriving, they will eventually cultivate not only the meadowland but also all of the scrubland. When a new settler, Cornelius, walks into town, the only land available will be the grassland, which is even less productive than scrubland. We can expect the same dance of negotiations: Cornelius will offer money to landlords to try to get onto scrubland, rents will quickly rise on scrubland, and the differential between scrubland and meadow will have to stay the same (or farmers would want to move), so the rent will rise on meadow too. The rent on meadowland, therefore, will always be equal to the difference in grain yield between meadowland and whatever land is available rent-free to new farmers. Economists call this other land marginal land because it is at the margin between being cultivated and not being cultivated. (You will soon see that economists think about decisions at the margin quite a lot.) In the beginning, when meadowland was more plentiful than settlers, it was not only the best land, it was also the marginal land because new farmers could use it. Because the best land was the same as the marginal land, there was no rent, beyond the trivial sum needed to compensate the landlord for his trouble. Later, when there were so many farmers that there was no longer enough prime land to go around, scrubland became the marginal land, and rents on meadows rose to five bushels a year-the difference in productivity between the meadowland and the marginal land (in this case, the scrubland). When Cornelius arrived, the grassland became the marginal land, meadows became yet more attractive relative to the marginal land, and so the landlords were able to raise the rent on meadows again. It's important to note here that there is no absolute value: everything is relative to that marginal land. From meadows back to coffee kiosks A nice story, but those of us who like Westerns may prefer the gritty cinematography of Unforgiven or the psychological isolation of High Noon. So, David Ricardo and I get no prizes for our screenwriting, but we might be excused, as long as our little fable actually tells us something useful about the modern world. We can start with coffee kiosks. Why is coffee expensive in London, New York, Washington, or Tokyo? The commonsense view is that coffee is expensive because the coffee kiosks have to pay high rent. David Ricardo's model can show us that this is the wrong way to think about the issue, because high rent is not an arbitrary fact of life. It has a cause. Ricardo's story illustrates that two things determine the rent on prime locations like meadowland: the difference in agricultural productivity between meadows and marginal land, and the importance of agricultural productivity itself. At a dollar a bushel, five bushels of grain is a five-dollar rent. At two hundred thousand dollars a bushel, five bushels of grain is a million-dollar rent. Meadows command high dollar rents only if the grain they help produce is also valuable. Now apply Ricardo's theory to coffee bars. Just as meadowland will command high rents if the grain they produce is valuable, prime coffee-bar locations will command high rents only if customers will pay high prices for coffee. Rush-hour customers are so desperate for caffeine and in such a hurry that they are practically price-blind. The willingness to pay top dollar for convenient coffee sets the high rent, and not the other way around. Spaces suitable for coffee kiosks are like meadows-they are the best quality property for the purpose, and they fill up quickly. The ground-floor corner units of Manhattan's Midtown are the preserve of Starbucks, Cosi, and their competitors. Near Washington, D.C.'s Dupont Circle, Cosi has the prime spot at the southern exit, and Starbucks has the northern one, not to mention staking out territory opposite the adjacent stations up and down the Metro line. In London, AMT has Waterloo, King's Cross, Marylebone, and Charing Cross stations, and indeed every London station hosts one of the big-name coffee chains. These spots could be used to sell secondhand cars or Chinese food, but they never are. This isn't because a train station is a bad place to sell a Chinese meal or a secondhand car, but because there is no shortage of other places with lower rents from which noodles or cars can be sold-customers are in less of a hurry, more willing to walk, or order a delivery. For coffee bars and similar establishments selling snacks or newspapers, cheaper rent is no compensation for the loss of a flood of price-blind customers. Portable models David Ricardo managed to write an analysis of cappuccino bars in train stations before either cappuccino bars or train stations existed. This is the kind of trick that makes people either hate or love economics. Those who hate it argue that if we want to understand how the modern coffee business works, we should not be reading an analysis of farming published in 1817. But many of us love the fact that Ricardo was able, nearly two hundred years ago, to produce insights that illuminate our understand- ing today. It's easy to see the difference between nineteenth-century farming and twenty-first-century frothing, but not so easy to see the similarity before it is pointed out to us. Economics is partly about modeling, about articulating basic principles and patterns that operate behind seemingly complex subjects like the rent on farms or coffee bars. There are other models of the coffee business, useful for different things. A model of the design and architecture of coffee bars could be useful as a case study for interior designers. A physics model could outline the salient features of the machine that generates the ten atmospheres of pressure required to brew espresso; the same model might be useful for talking about suction pumps or the internal combustion engine. Today we have models of the ecological impacts of different disposal methods for coffee grounds. Each model is useful for different things, but a model that tried to describe the design, the engineering, the ecology, and the economics would be no simpler than reality itself and so would add nothing to our understanding. Ricardo's model is useful for discussing the relationship between scarcity and bargaining strength, which goes far beyond coffee or farming and ultimately explains much of the world around us. When economists see the world, they see hidden social patterns, patterns that become evident only when one focuses on the essential underlying processes. This focus leads critics to say that economics doesn't consider the whole story, the whole system. How else, though, could a nineteenth-century analysis of farming proclaim the truth about twenty-first-century coffee bars, except through grossly failing to notice all kinds of important differences? The truth is that it's simply not possible to understand anything complicated without focusing on certain elements to reduce that complexity. Economists have certain things they like to focus on, and scarcity is one of them. This focus means that we do not notice the mechanics of the espresso machine, nor the color schemes of the coffee bars, nor other interesting, important facts. But we gain from that focus, too, and one of the things we gain is an understanding of the system-the economic system, which is far more all-encompassing than many people realize. A word of caution is appropriate, though. The simplifications of economic models have been known to lead economists astray. Ricardo himself was an early casualty. He tried to extend his brilliantly successful model of individual farmers and landlords to explain the division of income in the whole economy: how much went to workers, how much to landlords, and how much to capitalists. It didn't quite work, because Ricardo treated the whole agricultural sector as if it were one vast farm with a single landlord. A unified agricultural sector had nothing to gain from improving the land's productivity with roads or irrigation, because those improvements would also reduce the scarcity of good land. But an individual landlord in competition with the others would have plenty of incentive to make improvements. Tied up in the technical details, Ricardo failed to realize that thousands of landlords competing with each other would make different decisions than a single one. So Ricardo's model can't explain everything. But we are about to discover that it goes farther than Ricardo himself could ever have imagined. It doesn't just explain the principles behind coffee bars and farming. If applied correctly, it shows that environmental legislation can dramatically affect income distribution. It explains why some industries naturally have high profits, while in other industries high profits are a sure sign of collusion. It even manages to explain why educated people object to immigration by other educated people, while the working classes complain about immigration by other unskilled workers. Different reasons for high rent Do you care if you get ripped off? I do. A lot of things in this life are expensive. Of course, sometimes that expense is a natural outcome of the power of scarcity. For instance, there are not many apartments overlooking Central Park in New York or Hyde Park in London. Because so many people want them, those apartments are expensive, and a lot of people end up being disappointed. There is nothing sinister about that. But it's not nearly so obvious why popcorn is so expensive at the movies-there was no popcorn shortage last time I checked. So the first

Publication Details

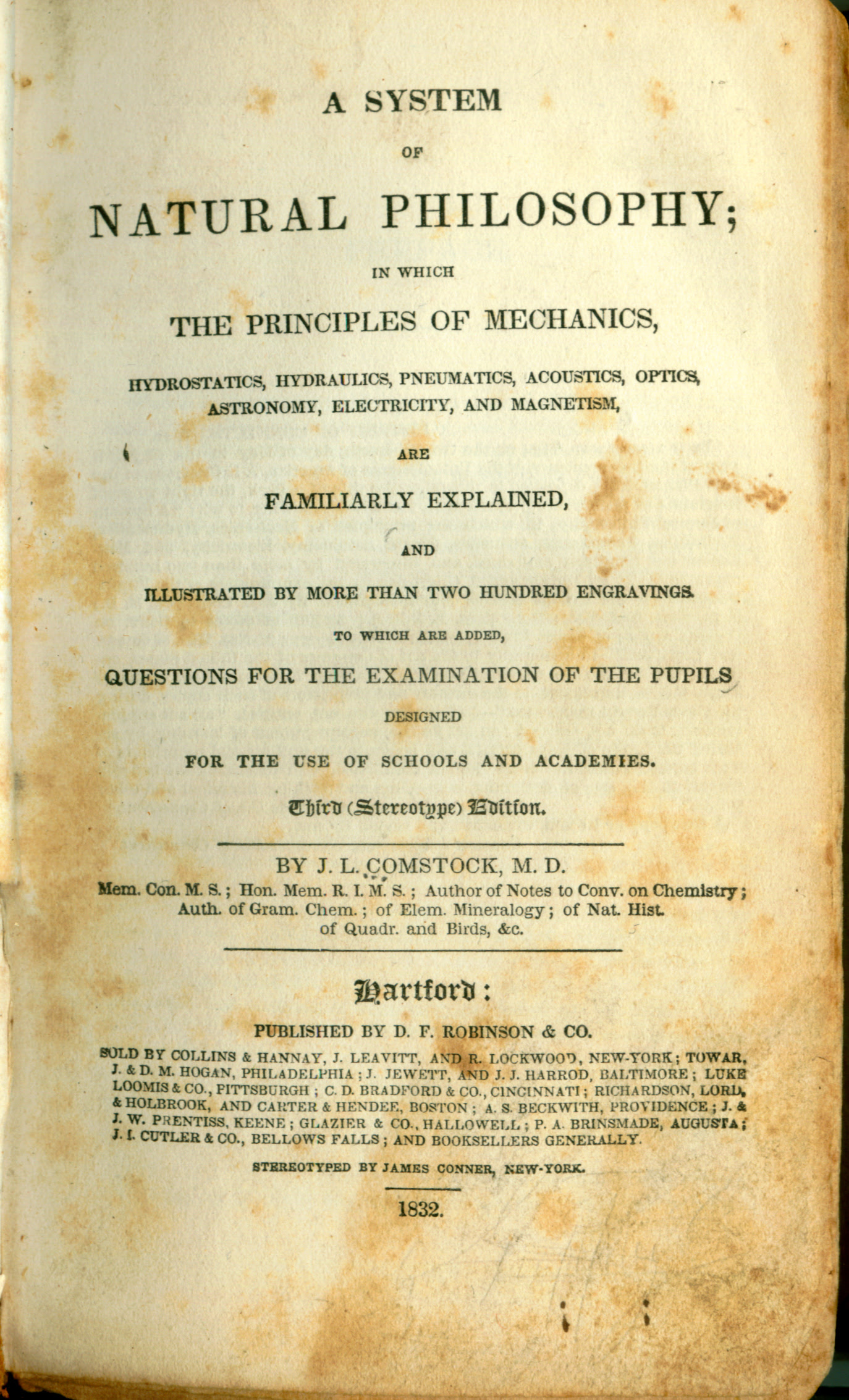

Title:

Author(s):

Illustrator:

Binding: Paperback

Published by: Little, Brown: , 2006

Edition:

ISBN: 9780316731164 | 0316731161

288 pages.

Book Condition: Very Good

Pickup available at Book Express Warehouse

Usually ready in 4 hours

Product information

New Zealand Delivery

Shipping Options

Shipping options are shown at checkout and will vary depending on the delivery address and weight of the books.

We endeavour to ship the following day after your order is made and to have pick up orders available the same day. We ship Monday-Friday. Any orders made on a Friday afternoon will be sent the following Monday. We are unable to deliver on Saturday and Sunday.

Pick Up is Available in NZ:

Warehouse Pick Up Hours

- Monday - Friday: 9am-5pm

- 62 Kaiwharawhara Road, Wellington, NZ

Please make sure we have confirmed your order is ready for pickup and bring your confirmation email with you.

Rates

-

New Zealand Standard Shipping - $6.00

- New Zealand Standard Rural Shipping - $10.00

- Free Nationwide Standard Shipping on all Orders $75+

Please allow up to 5 working days for your order to arrive within New Zealand before contacting us about a late delivery. We use NZ Post and the tracking details will be emailed to you as soon as they become available. Due to Covid-19 there have been some courier delays that are out of our control.

International Delivery

We currently ship to Australia and a range of international locations including: Belgium, Canada, China, Switzerland, Czechia, Germany, Denmark, Spain, Finland, France, United Kingdom, United States, Hong Kong SAR, Thailand, Philippines, Ireland, Israel, Italy, Japan, South Korea, Malaysia, Netherlands, Norway, Poland, Portugal, Sweden & Singapore. If your country is not listed, we may not be able to ship to you, or may only offer a quoting shipping option, please contact us if you are unsure.

International orders normally arrive within 2-4 weeks of shipping. Please note that these orders need to pass through the customs office in your country before it will be released for final delivery, which can occasionally cause additional delays. Once an order leaves our warehouse, carrier shipping delays may occur due to factors outside our control. We, unfortunately, can’t control how quickly an order arrives once it has left our warehouse. Contacting the carrier is the best way to get more insight into your package’s location and estimated delivery date.

- Global Standard 1 Book Rate: $37 + $10 for every extra book up to 20kg

- Australia Standard 1 Book Rate: $14 + $4 for every extra book

Any parcels with a combined weight of over 20kg will not process automatically on the website and you will need to contact us for a quote.

Payment Options

On checkout you can either opt to pay by credit card (Visa, Mastercard or American Express), Google Pay, Apple Pay, Shop Pay & Union Pay. Paypal, Afterpay and Bank Deposit.

Transactions are processed immediately and in most cases your order will be shipped the next working day. We do not deliver weekends sorry.

If you do need to contact us about an order please do so here.

You can also check your order by logging in.

Contact Details

- Trade Name: Book Express Ltd

- Phone Number: (+64) 22 852 6879

- Email: sales@bookexpress.co.nz

- Address: 62 Kaiwharawhara Rd, Kaiwharawhara, Wellington, 6035, New Zealand.

- GST Number: 103320957 - We are registered for GST in New Zealand

- NZBN: 9429031911290

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return.

To be eligible for a return, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

To start a return, you can contact us at sales@bookexpress.co.nz. Please note that returns will need to be sent to the following address: 62 Kaiwharawhara Road, Wellington, NZ once we have confirmed your return.

If your return is accepted, we’ll send you a return shipping label, as well as instructions on how and where to send your package. Items sent back to us without first requesting a return will not be accepted.

You can always contact us for any return question at sales@bookexpress.co.nz.

Damages and issues

Please inspect your order upon reception and contact us immediately if the item is defective, damaged or if you receive the wrong item, so that we can evaluate the issue and make it right.

Exceptions / non-returnable items

Certain types of items cannot be returned, like perishable goods (such as food, flowers, or plants), custom products (such as special orders or personalized items), and personal care goods (such as beauty products). We also do not accept returns for hazardous materials, flammable liquids, or gases. Please get in touch if you have questions or concerns about your specific item.

Unfortunately, we cannot accept returns on sale items or gift cards.

Exchanges

The fastest way to ensure you get what you want is to return the item you have, and once the return is accepted, make a separate purchase for the new item.

European Union 14 day cooling off period

Notwithstanding the above, if the merchandise is being shipped into the European Union, you have the right to cancel or return your order within 14 days, for any reason and without a justification. As above, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

Refunds

We will notify you once we’ve received and inspected your return, and let you know if the refund was approved or not. If approved, you’ll be automatically refunded on your original payment method within 10 business days. Please remember it can take some time for your bank or credit card company to process and post the refund too.

If more than 15 business days have passed since we’ve approved your return, please contact us at sales@bookexpress.co.nz.